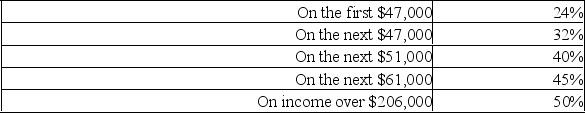

Steven James earned $150,000 this year in profits from his proprietorship.The rate of tax for Canadian-controlled private corporations in his province is 13% on the first $500,000 of income.Personal tax rates (federal plus provincial)in James' province are:

(All rates are assumed for this question.)

(All rates are assumed for this question.)

Steven withdraws $3,000 per month for his personal living expenses.All remaining profits are used to pay taxes and to expand the business.Steven expects the same business after-tax profits next year.

Steven is considering incorporating his business next year.If he incorporates,he will pay himself a gross salary of $48,000.

Required:

A.Determine the increase in Steven's cash flow if he incorporates his company? Show all calculations.

B.Name the type of tax planning that Steve would be engaging in if he incorporated his company.

Definitions:

Demographic Transition

A model describing changes in birth and death rates in a country as it develops, leading to stabilization of the population.

Birth Rate

The frequency at which births occur in a population per unit time, often measured as the number of births per 1,000 people per year.

Death Rate

The number of deaths per unit of population within a specific time frame, often expressed per 1,000 or 100,000 individuals per year.

Demographic Transition

The transition from high birth and death rates to low birth and death rates, accompanying economic development and improvements in living conditions.

Q5: The following cases pertain to some of

Q6: Andrew has $10,000 to invest.He wants to

Q7: The shareholders of Parent Co.and Sub Co.wish

Q51: If on Tuesday you can buy 125

Q63: Which of the following is true of

Q64: Topics in the field of organizational behavior

Q73: Which of the following is not an

Q74: Which part of an organizational system is

Q113: A speculator in foreign exchange is a

Q121: Griffin presents a way of integrating the