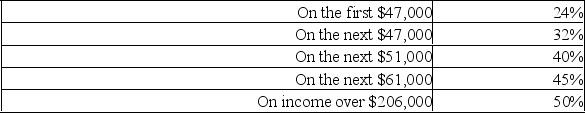

Steven James earned $150,000 this year in profits from his proprietorship.The rate of tax for Canadian-controlled private corporations in his province is 13% on the first $500,000 of income.Personal tax rates (federal plus provincial)in James' province are:

(All rates are assumed for this question.)

(All rates are assumed for this question.)

Steven withdraws $3,000 per month for his personal living expenses.All remaining profits are used to pay taxes and to expand the business.Steven expects the same business after-tax profits next year.

Steven is considering incorporating his business next year.If he incorporates,he will pay himself a gross salary of $48,000.

Required:

A.Determine the increase in Steven's cash flow if he incorporates his company? Show all calculations.

B.Name the type of tax planning that Steve would be engaging in if he incorporated his company.

Definitions:

Field Selectors

Instructions or expressions in a query that specify which fields or columns of data are to be displayed or manipulated in the output result.

Record Selector Button

A graphical control element that allows users to select records, typically seen in database applications or spreadsheets.

Column Heading

The label or title at the top of a column that describes the type of data that column contains, often found in spreadsheets and tables.

Record Deletion Button

A feature in database and some applications which allows users to remove specific records or entries with a single click.

Q1: Blue Co.earned $80,000 in revenue and paid

Q3: Jasmine is the beneficiary of an inter

Q7: Silver Photo Studios Inc.requires $50,000 capital for

Q7: The shareholders of Parent Co.and Sub Co.wish

Q9: Cindy works for Sky Manufacturers Ltd.,which is

Q34: Which of the following statements about the

Q37: When is a balance of payments account

Q62: The country of Yipi can raise its

Q94: In 2006,high-income economies with only about one

Q157: All _,regardless of whether they are large