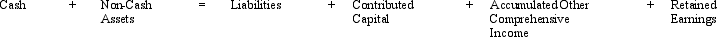

The analytical framework used to evaluate transactions is reproduced below:

Using this analytical framework indicate the effect of each of the following transactions for Staples Corporation:

Using this analytical framework indicate the effect of each of the following transactions for Staples Corporation:

1.Staples recorded cash sales of $25,000.The merchandise had cost $19,000 to manufacture.

2.Staples purchased $8,500 of raw material inventory on account.

3.The company paid $2,500 for property insurance for the next 12 months.

4.Staples paid its employees $5,000 for the month.

5.The company purchased $1,000 of supplies on account.

6.Staples issued $25,000 of long-term debt.

7.The company used $10,000 of excess cash to purchase marketable securities.

8.Staples purchased a machine for $16,000 using $8,000 cash with the balance on account.

9.Staples paid $2,500 for interest expense on the long-term debt.

10.At the end of the year the marketable securities that Staples purchased in transaction 7 were now worth $14,500.

11.Depreciation for the period was $1,500.

12.Staples examined the equipment and determined that its fair value was $10,000.

Definitions:

LLP

Stands for Limited Liability Partnership, a type of partnership where some or all partners have limited liabilities, blending elements of partnerships and corporations.

Net Income

Profit after deduction of all operational, interest, and tax expenses.

Capital Account Balance

A measure of the financial value of a nation's assets minus liabilities in the capital account, reflecting changes like foreign investment.

Partnership Capital

The total funds contributed by the partners of a partnership firm, which are used in the business and represented on the firm's balance sheet.

Q1: Porter Corporation NOTE: The following multiple choice

Q12: Use the current asset section of the

Q22: Which of the following statements about the

Q40: Net Devices Inc. The following balance sheets

Q84: Return on assets can be disaggregated into

Q89: Many people view the balance sheet as

Q90: What is the rationale for the statement

Q151: Which of the following is one of

Q153: The Limited has a competitive advantage in

Q166: When GE executives decided to sell NBC