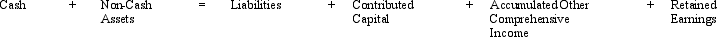

The analytical framework used to evaluate transactions is reproduced below:

Using this analytical framework indicate the effect of each of the following transactions for Staples Corporation:

Using this analytical framework indicate the effect of each of the following transactions for Staples Corporation:

1.Staples recorded cash sales of $25,000.The merchandise had cost $19,000 to manufacture.

2.Staples purchased $8,500 of raw material inventory on account.

3.The company paid $2,500 for property insurance for the next 12 months.

4.Staples paid its employees $5,000 for the month.

5.The company purchased $1,000 of supplies on account.

6.Staples issued $25,000 of long-term debt.

7.The company used $10,000 of excess cash to purchase marketable securities.

8.Staples purchased a machine for $16,000 using $8,000 cash with the balance on account.

9.Staples paid $2,500 for interest expense on the long-term debt.

10.At the end of the year the marketable securities that Staples purchased in transaction 7 were now worth $14,500.

11.Depreciation for the period was $1,500.

12.Staples examined the equipment and determined that its fair value was $10,000.

Definitions:

Tariffs

Taxes levied on imported or exported goods, used to regulate trade and protect domestic industries.

Monroe Administration

The presidential term of James Monroe, the fifth President of the United States, from 1817 to 1825, noted for the Monroe Doctrine, pronouncing opposition to European colonialism in the Americas.

Political Harmony

A state of agreement and cooperation among different political factions or parties, often resulting in more effective governance.

Intellectual Capacity

The ability of an individual to think, reason, and understand, encompassing aspects like creativity, problem-solving, and memory.

Q13: Use the following information to prepare a

Q15: To prevent unauthorized access,many firms rely on

Q29: Raleigh Manufacturing reported net income (amounts in

Q38: Deferred tax liabilities result in future tax

Q48: The basic functional purpose of operations systems

Q58: What three financial statements are prepared by

Q64: All of the following typically drive firm-specific

Q73: Caraway Company's net accounts receivable was $300,000

Q76: Match the following.You may use a response

Q79: Under IFRS,when an asset is revalued upwards,subsequent