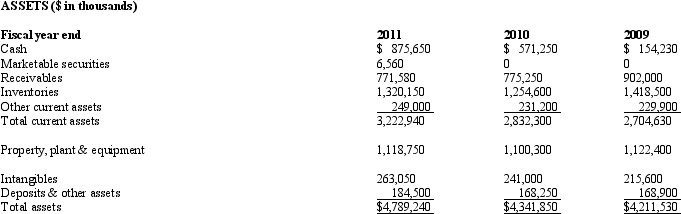

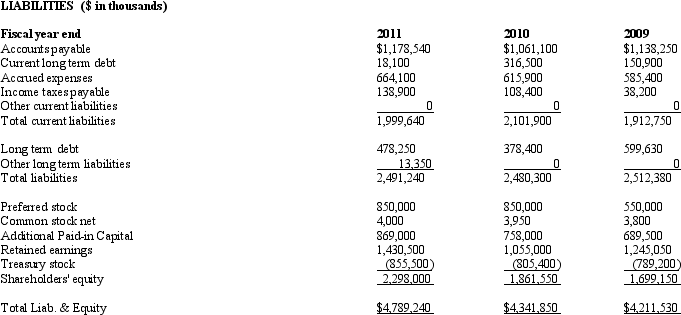

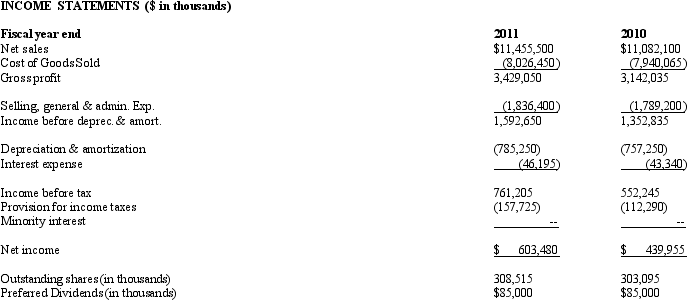

Net Devices Inc. The following balance sheets and income statements are for Net Devices Inc.,a manufacturer of small electronic devices,including calculators,personal digital assistants and mp3 players.For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the accounts receivable turnover ratio for Net Devices for 2011?

Refer to the information for Net Devices Inc.What is the accounts receivable turnover ratio for Net Devices for 2011?

Definitions:

Earnings

The amount of money that an individual or business receives in exchange for providing a good or service or through investing capital.

Term Life Insurance

A type of insurance that provides protection for the policyholder; term insurance covers the policyholder for a specified period of time, usually 5, 10, or 20 years; after that time, the policy is no longer in effect, unless it is renewed for another term.

Premium

The amount paid for an insurance policy.

Face Value

The nominal or stated value of a security or financial instrument, such as a bond, note, or coin.

Q18: The ability of a firm to generate

Q31: First Bank recognized an extraordinary loss from

Q33: Below are various states of financial distress:

Q44: All of the following are criteria that

Q55: All of the following are common industry

Q85: EBITDA not only ignores four expenses but

Q95: Ramos Company Ramos Company included the following

Q109: Simple systems in smaller organizations can use

Q123: Who are knowledge workers? Describe an organization

Q132: Productivity computations that deal with only one