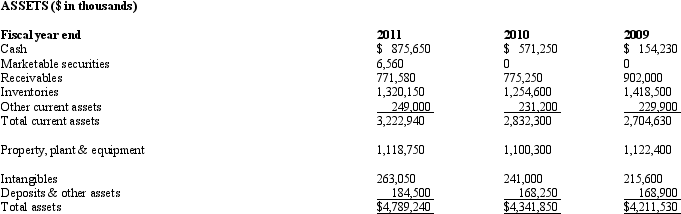

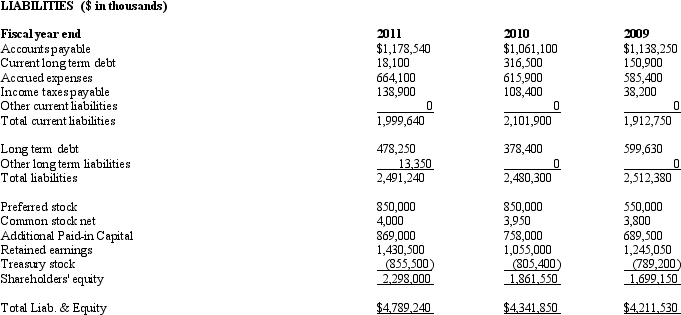

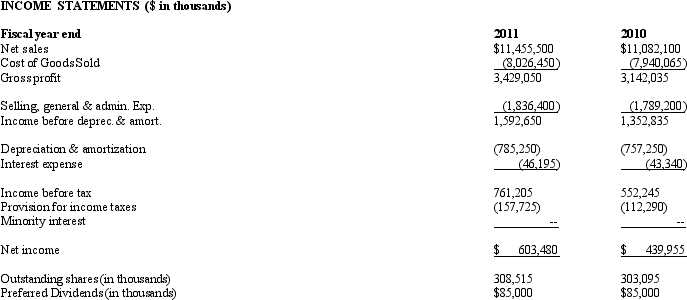

Net Devices Inc. The following balance sheets and income statements are for Net Devices Inc.,a manufacturer of small electronic devices,including calculators,personal digital assistants and mp3 players.For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the inventory turnover for Net Devices for 2011?

Refer to the information for Net Devices Inc.What is the inventory turnover for Net Devices for 2011?

Definitions:

Market Segmentation Theory

A theory suggesting that the bond market is segmented on the basis of maturity, influencing interest rates and investment strategies.

Debt Market

A market where investors buy and sell debt securities, typically bonds, which are promises to repay borrowed money.

Primary Market

A part of the capital market where new securities are initially sold to investors, typically through underwriting.

Secondary Market

A market where previously issued financial instruments such as stock, bonds, options, and futures are bought and sold.

Q5: When projecting operating expenses it is important

Q10: Many analysts use _ as a crude

Q14: The acceptable method of accounting for stock

Q26: What level are inputs for estimating fair

Q32: All of the following are primary events

Q48: Orca Industries Below are the two most

Q53: Cash flows from _ activities will normally

Q65: Extraordinary gains and losses arise from events

Q70: Large current ratios indicate the availability of

Q86: A gigantic network of networks serving millions