NOTE: This problem requires present value information.

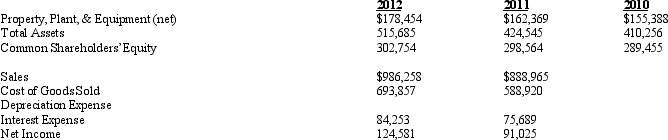

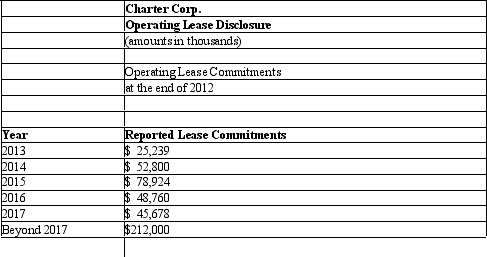

Charter Corp.manufactures office equipment and supplies throughout the U.S.The company owns property,plant,and equipment and also enters into operating leases for certain facilities.The company's tax rate is 35%.Listed below is selected financial data for Charter and the company's operating lease disclosure.

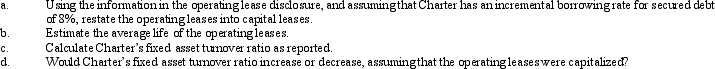

As an analyst you wish to restate Charter's operating leases into capital leases.

As an analyst you wish to restate Charter's operating leases into capital leases.

Required:

Definitions:

StomaphyX

A minimally invasive endoscopic procedure for resizing the stomach, typically to reverse weight gain after gastric bypass surgery.

Increased Blood Pressure

A condition where the force of the blood against the artery walls is higher than normal, which can lead to health problems.

Heart Rate

The number of heartbeats per unit of time, usually measured in beats per minute (bpm).

Sibutramine

A medication formerly used to treat obesity, which acts by suppressing appetite through the inhibition of serotonin, norepinephrine, and dopamine reuptake.

Q5: All of the following are typically recognized

Q11: Use of acquisition costs generally results in

Q15: Which of the following is not a

Q38: Houston,Inc. The following information pertains to Houston,Inc.a

Q42: Regarding actuarial assumptions,firms must disclose in notes

Q42: Orca Industries Below are the two most

Q49: Jurgen Company's income tax return shows income

Q56: One of the conditions that must be

Q66: What is the rationale for using expected

Q74: Which of the following would not be