Porter Corporation NOTE: The following multiple choice questions require present value information.

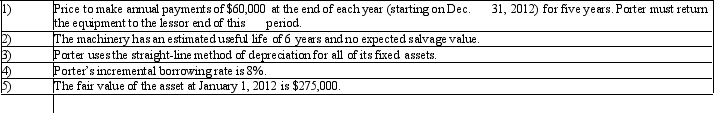

On January 1,2012,Porter Corporation signed a five-year noncancelable lease for certain machinery.The terms of the lease called for: For the year ended December 31,2012,Porter should record depreciation expense for the leased equipment equal to

For the year ended December 31,2012,Porter should record depreciation expense for the leased equipment equal to

Definitions:

Quarterly Contributions

Payments or deposits made into a financial account or investment plan every three months.

Annually Compounded

An interest calculation method where interest is added to the principal balance annually, increasing the amount of subsequent interest.

Annually Compounded

Compound interest calculated and added to the principal once a year, affecting the total interest earned or paid.

Nominal Rate

The interest rate stated on a bond or loan before adjusting for inflation or other factors.

Q2: Which of the following is not a

Q3: The ability of a firm to manage

Q17: Given the following information,calculate for Year 2

Q21: When attempting to identify the economic characteristics

Q39: Most publicly traded firms in the United

Q41: For each of the following scenarios,determine if

Q44: The payment of dividends would be classified

Q50: Which of the following valuation methods reflects

Q71: When a foreign entity has the foreign

Q97: Another term for earnings power is<br>A) nonrecurrent