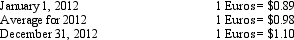

United owns Estada,a European based subsidiary for which the Euro is the functional currency.Estada had a net asset position at January 1,2012 of 1,200,000 Euros and reported income of 350,000 Euros for 2012,which was earned evenly throughout the year.In addition,Estada paid 100,000 Euros of dividends at December 31,2012.The following were in effect during 2012:

Definitions:

Discount Rate

The interest rate used to discount future cash flows to their present value, often reflecting the risk associated with the cash flows.

Projected Dividends

The estimated dividends a company plans to pay out to its shareholders in the future.

EPS Growth Rate

The percentage change in a company's Earnings Per Share (EPS) over a specified period, indicating the company's profitability growth.

Rate of Return

The gain or loss of an investment over a specified period, expressed as a percentage of the investment's cost.

Q3: Book value per share may not approximate

Q6: When cash collectibility is uncertain the _

Q7: To calculate a company's average tax rate

Q18: The ability of a firm to generate

Q40: Conceptually,why should an analyst expect the dividends

Q44: Accounting earnings numbers provide a basis for

Q50: What three elements are needed to value

Q56: A firm's cash flows will differ from

Q64: Disregarding cash flows with owners,over sufficiently long

Q78: Extreme Sports Company and All Sports Corporation