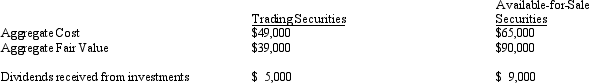

Stock Trader,Inc.began operations in 2012.Stock Trader has acquired a number of equity investments during 2012.None have been sold.Stock Trader exerts no influence over any of its investments each of which represents a small percentage of the investee.An analysis of Stock Trader's investment portfolios shows the following totals at December 31,2012:

Based on the information provided,describe how Stock Trader would present this information in its financial statements.You should discuss what amounts would appear in each financial statement.

Based on the information provided,describe how Stock Trader would present this information in its financial statements.You should discuss what amounts would appear in each financial statement.

Definitions:

Marginal Tax Rate

Marginal Tax Rate is the rate at which the last dollar of income is taxed, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Total Income

The sum of all earnings and other forms of income received by an individual or entity over a period of time.

Average Tax Rate

The percentage of total income that is paid in taxes.

Marginal Tax Rate

The percentage of tax applied to your next dollar of income, indicating the rate at which your last dollar earned is taxed.

Q27: Which of the following transactions would not

Q30: Falcon Networks Falcon Networks is a leading

Q48: Currently financial reporting does not take into

Q50: A company with a PEG ratio of

Q54: Derivative instruments acquired to hedge exposure may

Q57: As products move through the maturity phase,companies

Q62: Cash flows from _ activities will normally

Q76: An observable decline in cognitive abilities shortly

Q97: Kera's mother,father,and sister were all killed at

Q106: Kara sought caregivers for her father who