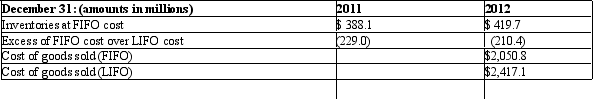

A large manufacturer recently changed its cost-flow assumption method for inventories at the beginning of 2012.The manufacturer has been in operation for almost 40 years,and for the last decade,it has reported moderate growth in revenues.The firm changed from the LIFO method to the FIFO method and reported the following information:

Definitions:

Market Price

The current quoted price for the exchange of an asset or service.

Subscription Price

The cost at which an investor can buy shares or units of a mutual fund or any other investment.

Q5: An equity security with systematic risk equal

Q7: If a firm competes in a capital-intensive

Q11: The process of allocating the historical cost

Q21: On September 1,2012,Ramos Inc.approved a plan to

Q35: In what case will using dividends expected

Q47: Below you will find the balance sheet

Q50: Death and loss are universal experiences that

Q58: Critics of EPS as a measure of

Q64: Advanced directives,often called "living wills," which are

Q89: Discuss the economic characteristics of firms that