Parnell Industries

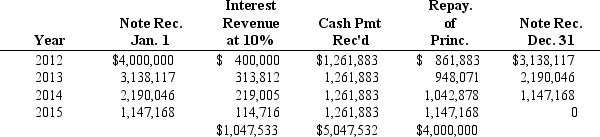

Parnell Industries sold a copy machine to Ranger Inc. on January 1, 2012. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Parnell to manufacture. Ranger will make four payments at the end of each year, beginning with 2012, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below:

-If Parnell Industries is uncertain that it will collect all four payments from Ranger Inc.and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Parnell recognize in 2012 from the sale?

Definitions:

Empowerment

The process of granting individuals or groups the autonomy, resources, and capability to make decisions and carry out actions in their roles.

Responsive

Being quick to react or respond positively or effectively to suggestions, requests, or changes.

Company's Needs

The requirements or demands of a business that must be met to achieve its objectives, including resources, workforce skills, and infrastructure.

Task Identity

The degree to which a job requires completion of a whole and identifiable piece of work.

Q4: Over sufficiently long periods,_ equals free cash

Q5: Accepting the reality that one has lost

Q8: The _ ratio indicates the number of

Q12: Implementing a dividend valuation model to determine

Q29: All of the following are steps in

Q34: Inventory turnover is calculated by dividing _

Q38: Common-size analysis requires the analyst to be

Q59: Creighton Corp.,a textile manufacturer,reported net income of

Q60: Residual income valuation focuses on _ as

Q101: Emille has voiced his concern regarding the