Techtronics is a leader in manufacturing computer chips,which is very capital-intensive.Because the production processes in computer chip manufacturing require sophisticated and rapidly changing technology,production and manufacturing assets in the chip industry tend to have relatively short useful lives.

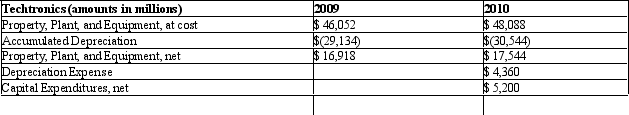

The following summary information relates to Techtronics' property,plant,and

equipment for 2009 and 2010:

Required

Required

Assume that Techtronics depreciates all property,plant,and equipment using the straight-line

depreciation method and zero salvage value.Assume that Intel spends $6,000 on new

depreciable assets in Year 1 and does not sell or retire any property,plant,and equipment

during Year 1.

a.Compute the average useful life that Techtronics used for depreciation in 2010.

b.Project total depreciation expense for Year 1 using the following steps: (i)project depreciation expense for Year 1 on existing property,plant,and equipment at the end of 2010; (ii)project depreciation expense on capital expenditures in Year 1 assuming that Intel takes a full year of depreciation in the first year of service; and (iii)sum the results of (i)and (ii)to obtain total depreciation expense for Year 1.

c.Project the Year 1 ending balance in property,plant,and equipment,both at cost

and net of accumulated depreciation.

Definitions:

Allowance for Doubtful Accounts

A contra-asset account that reduces the total receivables on the balance sheet to reflect the amount expected to be uncollectible.

Adjusting Entry

An adjustment recorded in the bookkeeping records at the end of an accounting period to allocate income and expenditure to the period in which they actually occurred.

Bad Debt Expense

The estimated amount of credit sales that are not expected to be collected, recognized as an expense in the income statement.

Uncollectible Accounts

Accounts receivable that a company does not expect to collect and writes off as a bad debt expense.

Q4: Which of the following is not one

Q29: As a firm progresses through the decline

Q35: Currently,suicide rates are highest for which population?<br>A)

Q38: In bankruptcy prediction analysis a type _

Q42: All of the following are logical steps

Q56: The major difference between accounting for pensions

Q57: Houston,Inc. The following information pertains to Houston,Inc.a

Q69: Which living arrangement is most desired by

Q95: When a company has a minority passive

Q96: A company would need to record an