Techtronics is a leader in manufacturing computer chips,which is very capital-intensive.Because the production processes in computer chip manufacturing require sophisticated and rapidly changing technology,production and manufacturing assets in the chip industry tend to have relatively short useful lives.

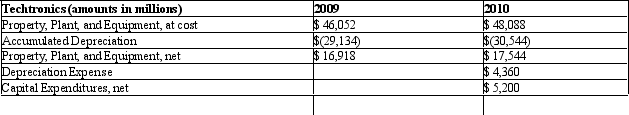

The following summary information relates to Techtronics' property,plant,and

equipment for 2009 and 2010:

Required

Required

Assume that Techtronics depreciates all property,plant,and equipment using the straight-line

depreciation method and zero salvage value.Assume that Intel spends $6,000 on new

depreciable assets in Year 1 and does not sell or retire any property,plant,and equipment

during Year 1.

a.Compute the average useful life that Techtronics used for depreciation in 2010.

b.Project total depreciation expense for Year 1 using the following steps: (i)project depreciation expense for Year 1 on existing property,plant,and equipment at the end of 2010; (ii)project depreciation expense on capital expenditures in Year 1 assuming that Intel takes a full year of depreciation in the first year of service; and (iii)sum the results of (i)and (ii)to obtain total depreciation expense for Year 1.

c.Project the Year 1 ending balance in property,plant,and equipment,both at cost

and net of accumulated depreciation.

Definitions:

Industry versus Inferiority

Erikson's fourth stage of psychosocial development, where children learn to master tasks and develop a sense of competency or inadequacy based on their successes or failures.

Identity Achievement

The stage in identity development where an individual has explored various options and made firm commitments to certain values, beliefs, and goals.

Marcia

A theory developed by James Marcia that categorizes an individual's progress toward their identity in terms of crisis and commitment across different life areas.

Field of Medicine

The Field of Medicine encompasses the science and practice of diagnosing, treating, and preventing diseases and injuries to improve health.

Q5: Which of the following ratios usually reflects

Q6: Which stage is Erikson's eighth and final

Q24: Increases in life expectancy have changed views

Q39: In some valuation scenarios,such as a leveraged

Q44: Free cash flow is calculated as net

Q53: Which of the following is not a

Q56: One of the conditions that must be

Q80: All of the following are conditions for

Q81: In order to measure how profitable a

Q88: An inventory pricing procedure in which the