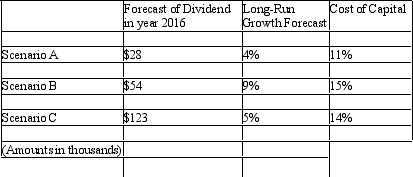

For each of the following scenarios determine the value as of the beginning of 2012 of the continuing dividend:

Definitions:

Cost of Equity

Represents the compensation the market requires to own equity in a company, reflecting the risk perceived by investors in holding that company's stocks.

Dividends

Disbursements issued by a company to its shareholders, apportioning some of the firm's profits among them.

Cost of Debt

The effective rate that a company pays on its borrowed funds from financial institutions or other sources.

Coupon Rate

A bond's interest rate per year, represented as a percentage of its face value.

Q3: During July 2012 Ralston Company decides to

Q4: Four-year-old Klaus kind of understands that his

Q14: Define terminal drop and how it relates

Q29: Compared to younger workers,the typical older worker

Q32: The most common chronic health problems of

Q34: When a long-lived asset loses its ability

Q48: Currently U.S.GAAP does not follow clean surplus

Q53: If the firm competes in a very

Q53: The _ is the date a firm

Q101: Emille has voiced his concern regarding the