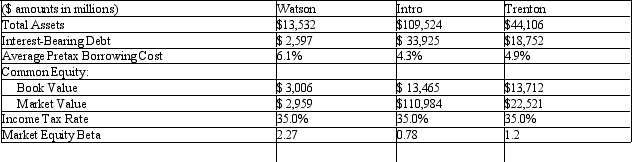

Watson manufactures and sells appliances.Intro develops and manufactures computer technology.Trenton operates general merchandise retail stores.Selected data for these companies appear in the following table (dollar amounts in millions).For each firm,assume that the market value of the debt equals its book value.

Required

Required

a.Assume that the intermediate-term yields on U.S.Treasury securities

are roughly 3.5 percent.Assume that the market risk premium is 5.0 percent.

Compute the cost of equity capital for each of the three companies.

b.Compute the weighted average cost of capital for each of the three companies.

c.Compute the unlevered market (asset)beta for each of the three companies.

Calculating the Cost of Capital.(Dollar Amounts in Millions)

Definitions:

Pricing Approach

The method a company uses to determine the selling price of its products or services, based on factors like cost, value, and competition.

E-book Sold

A digital version of a book that has been sold, either as a download or access through a specific platform.

Skimming Pricing Policy

A pricing strategy in which a company sets relatively high prices at the launch of a new product to maximize profit margins from customers willing to pay the premium price.

Price-sensitive

Refers to how demand for a product is influenced by changes in its price; price-sensitive consumers are likely to change their purchasing behaviors significantly in response to price changes.

Q8: A _ of operations differs from a

Q11: Santa Corporation NOTE: These multiple choice questions

Q23: Which theory proposes that people need to

Q26: Under an operating lease agreement the lessee

Q34: Which of the following best describes the

Q39: The _ is the date of closing

Q49: Many times a financial analyst may decide

Q63: Mobile Company Mobile Company manufactures computer technology

Q92: What were the biggest fears that the

Q96: A study that analyzed styles of aging