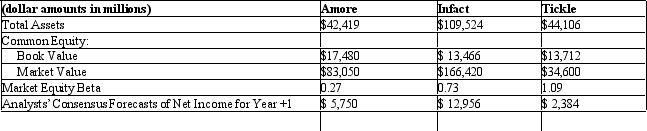

The following data represent total assets,book value,and market value of common shareholders' equity for Amore,Infact,and Tickle.Amore manufactures and sells cosmetics.Infact develops and manufactures computer chips.Tickle operates a chain of general merchandise stores.In addition,these data include existing market betas for the three firms and analysts' consensus forecasts of net income for Year +1

Assume that for each firm,analysts expect other comprehensive income items for

Year +1 to be zero; so Year +1 net income and comprehensive income will be identical.

Assume that the risk-free rate of return in the economy is 4.5 percent and the market risk

premium is 5.5 percent.

Required

Required

a.Using the CAPM,compute the required rate of return on equity capital for each

firm.

b.Project required income for Year +1 for each firm.

c.Project residual income for Year +1 for each firm.

d.What do the different amounts of residual income imply about each firm? Do the

projected residual income amounts help explain the differences in market value of

equity across these three firms? Explain.

Definitions:

Kilocalories

A unit of energy measurement in nutrition, commonly called a calorie, equivalent to 1000 small calories.

Energy Content

The amount of energy stored in a substance or system, which can be released or utilized through various processes.

Lipid

Substance composed principally of carbon, oxygen, and hydrogen; contains a lower ratio of oxygen to carbon and is less polar than carbohydrates; generally soluble in nonpolar solvents.

Carbohydrate

Monosaccharide (simple sugar) or the organic molecules composed of monosaccharides bound together by chemical bonds—for example, glycogen. For each carbon atom in the molecule, there are typically one oxygen molecule and two hydrogen molecules.

Q8: On January 1,2012,Brock Company purchased $200,000,8% bonds

Q13: Your roommate tells you to take care

Q37: Carmine's grandfather has come to live with

Q37: NOTE: This problem requires present value information.<br>Charter

Q46: The spirits of those that have died

Q51: The residual income valuation approach assumes that

Q53: Under current accounting rules an asset is

Q61: The textbook states,"Even dying can be a

Q64: In his younger days,Ronald would run in

Q72: Great-grandparenting offers the family<br>A) a sense of