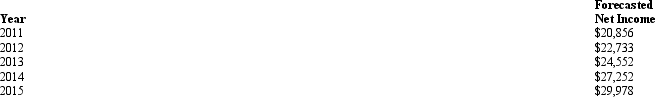

Jarrett Corp. At the end of 2010 Jarrett Corp.developed the following forecasts of net income: Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' was $112,768 on December 31,2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' was $112,768 on December 31,2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

Compute the value of Jarrett Corp.on January 1,2011,using the residual income valuation model.Use the half-year adjustment.

Definitions:

Q13: would describe Travis' emotional state as<br>A) a

Q14: Define terminal drop and how it relates

Q20: Achieving comparability in financial reporting is important

Q41: Residual income valuation focuses on<br>A) dividend-paying capacity

Q46: Financial statement forecasts are important analysis tools

Q52: People's attitude toward death depends on all

Q61: What does a price differential measure? How

Q67: Now that multigenerational families are beginning to

Q77: Lucas is 94 years old and his

Q82: Unrealized holding gains and losses from investments