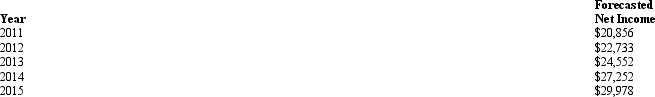

Jarrett Corp. At the end of 2010 Jarrett Corp.developed the following forecasts of net income: Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' was $112,768 on December 31,2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

Management believes that after 2015 Jarrett will grow at a rate of 7% each year.Total common shareholders' was $112,768 on December 31,2010.Jarrett has not established a dividend and does not plan to paying dividends during 2011 to 2015.Its cost of equity capital is 12%.

What would be Jarrett's residual income in 2013?

Definitions:

Labor

Work performed by humans that is used in the production of goods and services.

Equivalent Unit

A metric in cost accounting that quantifies the effort invested in partially finished units by equating it to the output of completely finished units.

First-in

implies the method where the earliest goods produced or acquired are the first to be used or sold.

Materials

Inputs and supplies used in the production of goods or in the provision of services.

Q23: At the beginning of 2012 investors had

Q27: The following data represent total assets,book value,and

Q38: Expenditures included in the cost of a

Q41: All of the following conditions signal that

Q49: Early in a period in which sales

Q66: Ashley Company Ashley Company purchased 2,000 of

Q70: Evaluate Erik Erikson's eighth and final stage,and

Q72: U.S.GAAP requires firms to report the assets

Q77: Snowflake Corp. Penguin,Inc.acquires 100% of the outstanding

Q85: According to Carstensen's socioemotional selectivity theory,which is