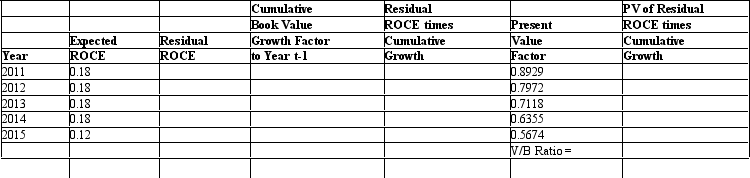

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 12 percent.Assume that the analyst forecasts that the firm will earn ROCE of 18 percent until year 2015,when the firm will start earning ROCE equal to 12 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Q6: In theory,all three valuation models,when correctly implemented

Q13: Accountants use reserve accounts for various reasons,for

Q27: Specifically identifiable intangible assets acquired from others

Q31: It may be difficult to forecast sales

Q50: The following balance sheet and income statement

Q53: Kübler-Ross states that in the overall process

Q56: Porter,Inc.is a distributor of electrical supplies.Management for

Q72: The text reported a study of married

Q101: Those older adults who reported higher levels

Q111: Who is most likely to have the