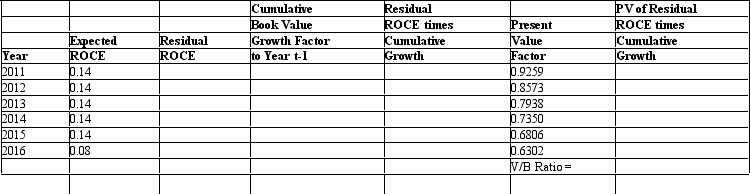

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent.Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2016,when the firm will start earning ROCE equal to 8 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Financial Statements

A collection of reports about an organization's financial results, financial position, and cash flows.

Regulatory Agencies

Government or authorized bodies that oversee and enforce standards and regulations in specific industries to ensure compliance and protect public interests.

Compensation Recovery

The process of reclaiming funds from employees, especially executives, usually due to non-compliance with contracts or in cases of restatement of financials due to misreporting.

Incentive Payments

Payments or bonuses provided to employees or executives beyond their regular salaries, often tied to performance goals or achievements.

Q3: Book value per share may not approximate

Q4: Which of the following is not one

Q6: Define both primary and secondary aging,and give

Q7: To calculate a company's average tax rate

Q8: Zonk Corp. The following data pertains to

Q9: The use of P/E ratios in valuation

Q16: Cooke Industries imports and sells quality merchandise.The

Q41: Hearing loss in middle age is<br>A) greater

Q42: Assume that a firm had shareholders' equity

Q75: Generalizing from the textbook,it could be concluded