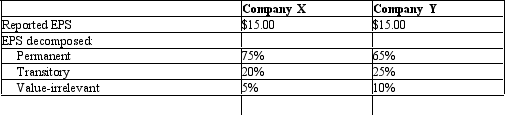

Use the following information to answer the requirements:

Required:

Required:

a.Use a risk-adjusted cost of capital of 15% to calculate each firm's implied share price and earning multiples.What are the implicit share prices and earnings multiples for the two firms different?

b.Repeat requirement a.,but use a risk-adjusted cost of capital of 8% instead.

Definitions:

Profit-Maximizing

The process of adjusting production and pricing strategies to achieve the highest possible profit from business operations.

Marginal Revenue

The additional income produced from selling one more unit of a good or service.

Economic Profit

The difference between the total revenue generated by a business and its total costs, including both explicit and implicit costs.

Market Price

The price at which a good or service is offered in the marketplace, determined by supply and demand dynamics.

Q17: Gains and losses differ from revenues and

Q18: The following financial statement data pertains to

Q37: Discuss under which scenario it is appropriate

Q41: The PE multiple assumes that firm value

Q50: A company with a PEG ratio of

Q68: A large manufacturer recently changed its cost-flow

Q70: Mike and Laura's children are grown-up and

Q90: All of the following are stages of

Q114: Which theory states that the more participatory

Q116: Of the following,who is likely to find