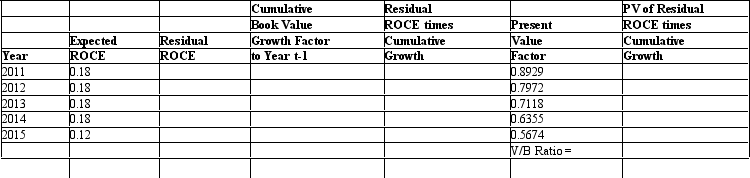

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 12 percent.Assume that the analyst forecasts that the firm will earn ROCE of 18 percent until year 2015,when the firm will start earning ROCE equal to 12 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

FRCP 26

A rule within the Federal Rules of Civil Procedure that outlines the general provisions governing discovery, including the duty to disclose and the scope of discovery.

Initial Disclosures

Mandatory, early sharing of non-privileged information relevant to a case, required by the court to facilitate a fair and efficient legal process.

Reasonable Expenses

Costs that are deemed necessary and prudent under certain circumstances, often evaluated in legal or financial contexts.

Discovery Plan

A plan formed by the attorneys litigating a lawsuit on behalf of their clients that indicates the types of information that will be disclosed by each party to the other prior to trial, the testimony, and evidence that each party will or may introduce at trial, and the general schedule for pretrial disclosures and events.

Q8: On January 1,2012,Brock Company purchased $200,000,8% bonds

Q10: Under the cash-flow-based valuation approach,free cash flows

Q22: In old age,reserve capacity tends to<br>A) increase.<br>B)

Q24: The best measure of a firm's sustainable

Q33: At the beginning of 2012 investors had

Q39: According to gerontologists,individuals who are counted among

Q47: Below you will find the balance sheet

Q60: Which of the following is NOT a

Q83: When adults work to leave a legacy

Q94: Gloria eats right,exercises,and lives a healthy lifestyle.Gloria's