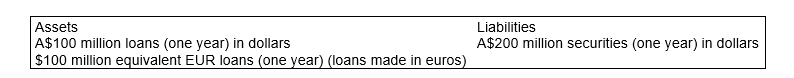

Suppose an FI has the following assets and liabilities: To invest $100 million of the $200 million securities in one-year euro loans, the Australian FI engaged in the following transactions:

To invest $100 million of the $200 million securities in one-year euro loans, the Australian FI engaged in the following transactions:

At the beginning of the year, it sold $100 million for euros on the spot currency markets at an exchange rate of A$2 to €1.

It takes the equivalent euro amount and makes one-year euro loans at a 15 per cent interest rate.

At the end of the year, the Australian FI repatriates the funds back to Australia at the same spot currency market rate of A$2/ €1.

a) Calculate the equivalent euro amount of $100 million using the spot exchange rate stated in transaction (1).

b) Calculate the value of the euro assets at the end of the year.

c) Calculate the dollar proceed of the euro investment.

d) Assume that the A$100 million loans yield a rate of 10 per cent p.a. What is the FI's weighted return on investments?

Definitions:

Fraud

The intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right.

Misrepresentation

A false or misleading statement that induces another party to enter into a contract or agreement, which can lead to legal remedies.

Engine Recall

An engine recall is a notice from a vehicle manufacturer to return a vehicle to the dealer for corrective action due to a discovered defect in the engine component.

Refund

Money returned to a purchaser in response to a dissatisfaction with goods or services, or cancellation of a service.

Q6: According to Gray (1988),the higher a country

Q20: When does 'duration' become a less accurate

Q20: Under an interest rate cap, in return

Q21: Normative accounting theories and research seek to:<br>A)

Q26: Consider an FI with the following off-balance-sheet

Q28: Proof the following three propositions using a

Q48: Collateralised mortgage obligation (CMO) is a mortgage-backed

Q48: The buyer of a bond call option:<br>A)

Q51: The dollar loss/gain in a particular currency

Q52: Which of the following are the two