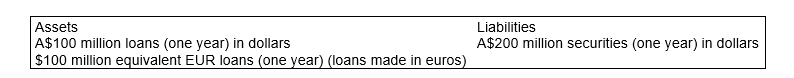

Suppose an FI has the following assets and liabilities: To invest $100 million of the $200 million securities in one-year euro loans, the Australian FI engaged in the following transactions:

To invest $100 million of the $200 million securities in one-year euro loans, the Australian FI engaged in the following transactions:

At the beginning of the year, it sold $100 million for euros on the spot currency markets at an exchange rate of A$2 to €1.

It takes the equivalent euro amount and makes one-year euro loans at a 15 per cent interest rate.

At the end of the year, the Australian FI repatriates the funds back to Australia at the same spot currency market rate of A$2/ €1.

a) Calculate the equivalent euro amount of $100 million using the spot exchange rate stated in transaction (1).

b) Calculate the value of the euro assets at the end of the year.

c) Calculate the dollar proceed of the euro investment.

d) Assume that the A$100 million loans yield a rate of 10 per cent p.a. What is the FI's weighted return on investments?

Definitions:

Empirical Research

Research based on observed and measured phenomena, relying on experimental or observational evidence.

Material Published

Material published refers to content such as books, articles, journals, and other documents that have been made available to the public through printing or electronic media.

Interview

A formal meeting where one or more persons question, consult, or evaluate another person, typically used for the purposes of selection, assessment, or information gathering.

Government Publication

A document issued by a government agency or body, often containing statistics, research findings, or legal texts.

Q2: The concentration limit for a loan portfolio

Q8: Which of the following arguments is used

Q15: Which of the following statements is true?<br>A)

Q15: Market risk is defined as the risk

Q21: Which of the following best describes a

Q49: Which of the following statements is true?<br>A)

Q49: Which of the following is an advantage

Q52: Which of the following statements is true?<br>A)

Q60: Which is of the statements below is

Q64: With increasing maturity of a fixed-income asset