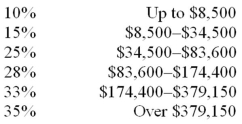

Using the following table,calculate the taxes for an individual with taxable income of $30,000.

Definitions:

Incentive Compensation

A form of payment designed to reward employees for achieving a certain goal, improving performance, or exhibiting a desired behavior.

Performance Measures

Metrics or indicators used to gauge the effectiveness, productivity, or success of an organization or individual’s activities.

Supervisors

Individuals within an organization responsible for overseeing the work of others, ensuring tasks are completed efficiently and effectively.

Incentive Compensation

A form of payment designed to reward employees for achieving certain performance targets.

Q3: Tom needs to complete his taxes.He should

Q23: If a businesses assets are going to

Q40: What can be the first step in

Q41: Fees,tips,and bonuses are forms of<br>A) Adjusted gross

Q58: A cash flow statement uses this equation:

Q73: When Angela wanted to provide financial security

Q78: If you think that rates will fall

Q92: Individuals can file their federal taxes using

Q102: Paul bought some bad gasoline that damaged

Q114: What are three tax strategies you can