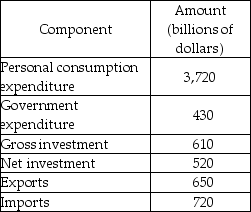

-Using the information in the table above, depreciation equals

Definitions:

AGI

Adjusted Gross Income, a measure of income calculated from your gross income and used to determine how much of your income is taxable.

Qualified Mortgage Interest

Interest paid on a mortgage that is eligible for tax deduction within the limits set by the IRS.

At-risk Rules

These are tax rules designed to limit the amount of deductible losses from businesses or income-producing activities to the amount the taxpayer has at risk.

Passive Loss Rules

Tax regulations that limit the amount of losses investors can deduct from passive activities, including some investments in real estate.

Q37: Gross domestic product (GDP)measures the<br>A) number of

Q71: On a time-series graph with a ratio

Q102: During an economic expansion, real GDP _

Q126: In the calculation of GDP by the

Q141: When the price of a good is<br>A)

Q198: Recessions and expansions affect most strongly which

Q217: In a country with a working-age population

Q244: If consumption expenditures are $500 million, net

Q259: A technological improvement lowers the cost of

Q375: Consumption expenditure is the payment by households