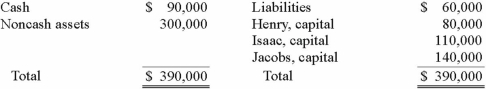

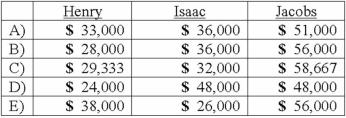

The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account balances:  Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4. Before liquidating any assets, the partners determined the amount of cash for safe payments and distributed it. The noncash assets were then sold for $120,000. The liquidation expenses of $5,000 were paid. How would the $120,000 be distributed to the partners?

Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4. Before liquidating any assets, the partners determined the amount of cash for safe payments and distributed it. The noncash assets were then sold for $120,000. The liquidation expenses of $5,000 were paid. How would the $120,000 be distributed to the partners?

(Hint: Either a predistribution plan or a schedule of safe payments would be appropriate for solving this item.)

Definitions:

Transfer

The act of moving assets, funds, or ownership rights from one entity to another.

Articles of Incorporation

Legal documents filed with a governmental body to legally document the creation of a corporation.

Organizational Structure

The system of hierarchy and arrangement within a company that outlines roles, responsibilities, and relationships between individuals and groups.

Types of Stock

Refers to the different categories of stock that a company issues, commonly including common stock and preferred stock.

Q19: If anaerobic glycolysis is only one-eighteenth as

Q20: A male peacock that displays showy and

Q22: Cholesterol belongs to which of the following

Q28: Explain Lamarck's theory of evolution and describe

Q34: On April 1, Quality Corporation, a U.S.

Q41: Quadros Inc., a Portuguese firm was

Q47: Which one of the following is NOT

Q64: How do subsidiary stock warrants outstanding affect

Q66: The Albert, Boynton, and Creamer partnership was

Q67: Certain balance sheet accounts of a foreign