Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

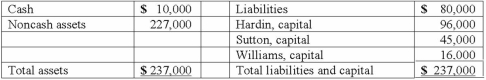

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Definitions:

Days' Sales Uncollected

Represents the average number of days it takes a company to collect payment after a sale has been made.

Q3: A foreign subsidiary uses the first-in first-out

Q12: What three criteria must be met to

Q13: Which of the following is NOT a

Q27: Pepe, Incorporated acquired 60% of Devin Company

Q29: A city starts a solid waste landfill

Q58: This chapter began with Pasteur disproving spontaneous

Q58: P, L, and O are partners with

Q86: On October 1, 2013, Eagle Company

Q89: On May 1, 2013, Mosby Company

Q92: What exchange rate would be used to