Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

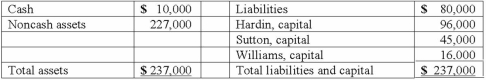

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Prepare journal entries to record the actual liquidation transactions.

Definitions:

Line Managers

Managers who are directly responsible for overseeing the performance of employees and the day-to-day operations of the business.

Labor Unions

Organizations that represent the collective interests of workers in negotiations with employers.

Negotiations

The process of discussing something with the intention of reaching an agreement.

Record-keeping Service

A system or service that maintains important records or documents, often for compliance, historical, or operational reasons.

Q9: Cleary, Wasser, and Nolan formed a partnership

Q9: Which item is not included on the

Q14: Both NADH and FADH<sub>2</sub> are produced by<br>A)

Q20: On January 1, 2012, Smeder Company, an

Q30: The alpha-helix is an example of the

Q40: Which process occurs in the cytoplasm outside

Q53: What is the purpose of fund financial

Q57: A net asset balance sheet exposure exists

Q66: A company had common stock with a

Q94: Gargiulo Company, a 90% owned subsidiary