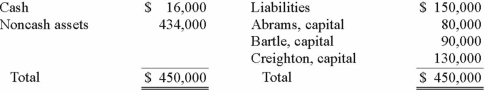

The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance sheet:  Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000. If the noncash assets were sold for $234,000, what amount of the loss would have been allocated to Bartle?

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000. If the noncash assets were sold for $234,000, what amount of the loss would have been allocated to Bartle?

Definitions:

Net Cash Flows

The difference between cash inflows and cash outflows within a specified period, reflecting the total amount of cash being transferred into and out of a business.

Estimated Cost

A projection or approximation of the cost associated with a particular project, product, or activity.

Cash Payback Period

The time it takes for an investment to generate enough cash flow to recoup the initial outlay.

Net Cash Flows

The difference between the cash inflows and outflows in a company during a specific period, reflecting the company’s overall liquidity position.

Q16: The ABCD Partnership has the following balance

Q22: What theoretical argument could be made against

Q25: How can a parent corporation determine the

Q28: Cyclin-dependent kinases and cyclins are most closely

Q34: On April 1, Quality Corporation, a U.S.

Q46: When a city holds pension monies for

Q59: Cleary, Wasser, and Nolan formed a partnership

Q85: These questions are based on the

Q88: Cleary, Wasser, and Nolan formed a partnership

Q123: Webb Co. acquired 100% of Rand Inc.