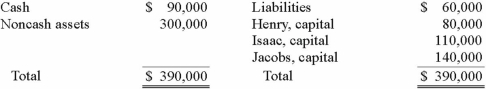

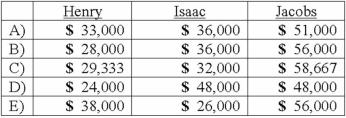

The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account balances:  Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4. Before liquidating any assets, the partners determined the amount of cash for safe payments and distributed it. The noncash assets were then sold for $120,000. The liquidation expenses of $5,000 were paid. How would the $120,000 be distributed to the partners?

Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4. Before liquidating any assets, the partners determined the amount of cash for safe payments and distributed it. The noncash assets were then sold for $120,000. The liquidation expenses of $5,000 were paid. How would the $120,000 be distributed to the partners?

(Hint: Either a predistribution plan or a schedule of safe payments would be appropriate for solving this item.)

Definitions:

Audit Process

A systematic examination of books, accounts, documents, and vouchers of an organization to ascertain how far the financial statements present a true and fair view.

Social Responsibility

The concept of organizations and individuals acting in a manner that considers the long-term impacts of their actions on the environment and society as a whole.

Ethics-Auditing

The process of reviewing and assessing the moral and ethical standards and practices within an organization to ensure compliance and integrity.

Auditing Activity

The systematic examination and evaluation of the financial statements, records, and operations of an organization to ensure accuracy and compliance with established standards.

Q13: Fargus Corporation owned 51% of the voting

Q22: Technically,differential survival and reproduction among offspring with

Q23: At its simplest,meiosis could be described as<br>A)

Q25: What factors create a foreign exchange gain?

Q37: What happens when a U.S. company sells

Q42: A local partnership was considering the

Q42: How is the cell theory related to

Q47: Assume the partnership of Howell, Madrid,

Q56: A(n)_ fatty acid has two or more

Q65: Meisner Co. ordered parts costing §100,000 for