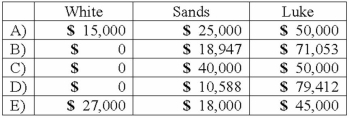

White, Sands, and Luke has the following capital balances and profit and loss ratios: $60,000 (30%) ; $100,000 (20%) ; and $200,000 (50%) .

The partnership has received a predistribution plan.

How would $90,000 be distributed?

Definitions:

Tax Return Lines

Specific lines on a tax return document where taxpayers report information or figures as required by tax regulations.

Detailed Reports

Comprehensive documents that provide an in-depth analysis or summary of data related to a specific topic or period.

Tailor

A tailor is a skilled craftsperson who makes, repairs, or alters clothing professionally, often creating garments to fit individual customers uniquely.

Permanent Accounts

Financial statement accounts whose balances are carried over into the next accounting period.

Q10: What account is debited in the general

Q16: A local partnership has assets of cash

Q23: At its simplest,meiosis could be described as<br>A)

Q28: Which item is not shown on the

Q28: Aerobic organisms use _ as the final

Q33: A five-year lease is signed by

Q34: On April 1, Quality Corporation, a U.S.

Q64: How do subsidiary stock warrants outstanding affect

Q80: Which method of remeasuring a foreign subsidiary's

Q101: Johnson, Inc. owns control over Kaspar Inc,