Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

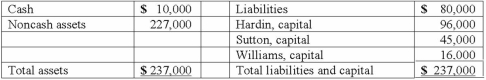

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Definitions:

Mechanic

A professional who repairs and maintains machinery, engines, and other mechanical equipment.

Mortgage

A mortgage is a legal agreement by which a bank or another creditor lends money at interest in exchange for taking title of the debtor's property, with the condition that the conveyance of title becomes void upon the payment of the debt.

Assignment

The transfer of rights, property, or obligations from one party to another.

Notice

A formal communication or announcement given to inform parties of legal actions, decisions, or the need for response, depending on specific legal or contractual requirements.

Q2: Which is true of enzyme-catalyzed reactions?<br>A) All

Q9: Cleary, Wasser, and Nolan formed a partnership

Q14: The partners of Donald, Chief &

Q17: During the creation court case in Arkansas,Judge

Q28: Proprietary funds are<br>A)Funds used to account for

Q34: The appropriate format of the December

Q47: What information is required in the financial

Q67: James, Keller, and Rivers have the following

Q67: Trapper City issued 30-year bonds for the

Q93: Which of the following is not a