Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

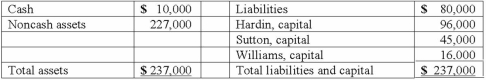

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Prepare journal entries to record the actual liquidation transactions.

Definitions:

Lochner V. New York

A landmark U.S. Supreme Court case from 1905 that struck down a New York law setting maximum working hours, ruling it as an unconstitutional interference with individual freedom of contract.

Right Of Contract

The legal ability of individuals or entities to enter into binding agreements without coercion or undue influence.

Individual Freedom

The liberty of an individual to act, speak, or think as one desires without hindrance or restraint, within the limits of law.

Federal Assistance

Financial or material support provided by the federal government to individuals, organizations, or state and local governments.

Q8: The balance sheet of Rogers, Dennis

Q20: When a city received a private donation

Q28: Knight Co. owned 80% of the common

Q32: Glycolysis produces a net yield of _

Q32: Attempting to understand proximate or immediate causes

Q37: What happens when a U.S. company sells

Q49: Which of the following is NOT one

Q85: Norek Corp. owned 70% of the voting

Q85: Quadros Inc., a Portuguese firm was

Q109: Where do dividends paid by a subsidiary