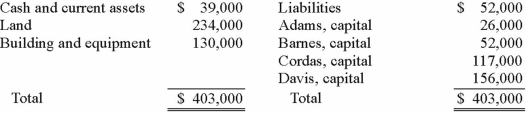

The ABCD Partnership has the following balance sheet at January 1, 2012, prior to the admission of new partner, Eden.

Eden acquired a 20% interest in the partnership by contributing a total of $71,500 directly to the other four partners. No goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Adams, 15%, Barnes, 35%, Cordas, 30%, and Davis, 20%. After Eden made his investment, what were the individual capital balances?

Eden acquired a 20% interest in the partnership by contributing a total of $71,500 directly to the other four partners. No goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Adams, 15%, Barnes, 35%, Cordas, 30%, and Davis, 20%. After Eden made his investment, what were the individual capital balances?

Definitions:

Perceived Ability

An individual's belief about how well they can perform or succeed in a particular task or activity.

Coping with Stress

Coping with stress involves employing strategies or behaviors to manage or reduce the psychological strain caused by stressors.

Alcohol

A psychoactive substance that is commonly consumed in beverages and can affect the central nervous system, leading to altered mood, behavior, and cognitive functions.

Posttraumatic Stress Disorder

A mental health condition triggered by experiencing or witnessing a terrifying event, leading to symptoms like flashbacks, nightmares, and severe anxiety.

Q10: The City of Wetteville has a fiscal

Q21: Jell and Dell were partners with capital

Q23: Kennedy Company acquired all of the outstanding

Q25: Which is NOT a characteristic of mitochondria?<br>A)

Q48: What assets would be included in the

Q60: Partnerships have alternative legal forms including all

Q65: Meisner Co. ordered parts costing §100,000 for

Q71: The capital account balances for Donald

Q79: Withdrawals from the partnership capital accounts are

Q80: Vontkins Inc. owned all of Quasimota Co.