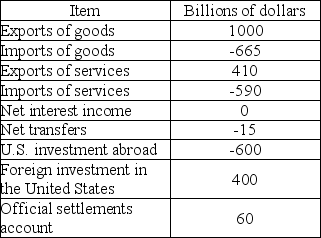

-The data in the table above are the U.S. balance of payments. The data show that

Definitions:

Tax Burden

The total amount of taxes that individuals or businesses must pay, often considered in relation to their income or profits.

Payroll Tax

Obligatory payments required from employers or employees, usually expressed as a proportion of the salaries employees receive.

Tax Burden

The total amount of taxes paid by individuals or businesses, expressed as a percentage of income or revenue, indicating the financial impact of taxation.

Payroll Tax

Taxes imposed on employers and/or employees, typically based on the wages or salaries paid, to fund social security and healthcare programs.

Q21: In the figure above, the shift in

Q108: What is the structure of the Federal

Q138: Using the data in the above table,

Q157: In the above figure, suppose the economy

Q227: In the above figure, if the interest

Q315: If net exports is a negative number,

Q333: The AD curve shows the sum of<br>A)

Q347: International data supports the quantity theory of

Q370: If a country's central bank does not

Q574: In the short run, how is the