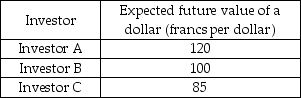

-Using the table above, if the current market value of the dollar is 125 francs per dollar

Definitions:

Beta

A gauge of the systematic risk or volatility of a security or a portfolio relative to the overall market.

Risk-Free Rate

The theoretical rate of return on an investment with no risk of financial loss, often represented by government bonds.

Market Neutral Bets

Investment strategies aiming to profit from both increasing and decreasing prices in one or more markets, whilst minimizing exposure to market risk.

Considerable Leverage

The use of borrowed capital to increase the potential return of an investment.

Q31: "If the official settlements balance is zero,

Q189: According to the quantity theory of money,

Q308: In response to the financial crisis of

Q316: If the current account balance is -$100

Q342: Suppose the exchange rate for the U.S.

Q404: The Federal Reserve System<br>A) regulates the nation's

Q412: The long-run aggregate supply (LAS)curve<br>A) has a

Q414: Which of the following is NOT a

Q455: Why is the nominal interest rate the

Q479: In the figure above, the shift in