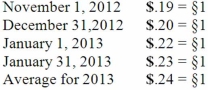

A subsidiary of Porter Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the Stickle (§) , the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2012, for §120,000 that was sold on January 17, 2013 for §156,000. The subsidiary paid for the inventory on January 31, 2013. Currency exchange rates between the dollar and the Stickle were as follows:  What amount would have been reported for this inventory in Porter's consolidated balance sheet at December 31, 2012?

What amount would have been reported for this inventory in Porter's consolidated balance sheet at December 31, 2012?

Definitions:

WACC

Weighted Average Cost of Capital (WACC) is the average rate of return a company is expected to pay its security holders to finance its assets.

IRR

Internal Rate of Return; a financial metric used to estimate the profitability of potential investments.

NPVs

NPVs, or Net Present Values, is a financial metric that calculates the difference between the present value of cash inflows and outflows over a period of time.

Expansion

The process by which a company grows in size, scope, or production capacity, often through increased output or market presence.

Q2: If a fish is placed in an

Q8: The ABCD Partnership has the following balance

Q19: On October 1, 2013, Eagle Company

Q28: On October 1, 2013, Eagle Company

Q34: The appropriate format of the December

Q54: Reproduction of organisms involves the apparently contradictory

Q76: What documents or other sources of information

Q96: Perch Co. acquired 80% of the common

Q101: Gargiulo Company, a 90% owned subsidiary

Q107: Ryan Company owns 80% of Chase