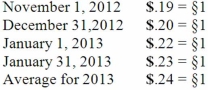

A subsidiary of Porter Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the Stickle (§) , the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2012, for §120,000 that was sold on January 17, 2013 for §156,000. The subsidiary paid for the inventory on January 31, 2013. Currency exchange rates between the dollar and the Stickle were as follows:  What amount would have been reported for cost of goods sold on Porter's consolidated income statement at December 31, 2013?

What amount would have been reported for cost of goods sold on Porter's consolidated income statement at December 31, 2013?

Definitions:

HPIP System

High-Performance Incentive Program, a strategy designed to improve efficiency and outcomes through incentives.

Patient Reminders

Notifications sent to patients to remind them of upcoming appointments, medication schedules, or other health-related tasks to enhance care compliance.

Preventive Care

Healthcare practices aimed at preventing diseases rather than treating them.

Follow-Up Care

Ongoing care and treatment given to a patient following the initial treatment of a condition or after being discharged from a healthcare facility to ensure recovery or monitor health status.

Q13: Yoderly Co., a wholly owned subsidiary of

Q19: A method of depreciation for infrastructure assets

Q23: The capital account balances for Donald

Q31: Knight Co. owned 80% of the common

Q37: The following information has been taken from

Q43: Pell Company acquires 80% of Demers

Q47: Gargiulo Company, a 90% owned subsidiary

Q53: Which of these is a variation of

Q86: A partnership began its first year of

Q94: When a subsidiary is acquired sometime after