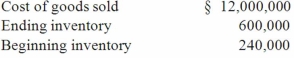

A U.S. company's foreign subsidiary had the following amounts in stickles (§) in 2013:  The average exchange rate during 2013 was §1 = $.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $.90. The exchange rate at December 31, 2013 was §1 = $.84. Assuming that the foreign country had a highly inflationary economy, at what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2013 U.S. dollar income statement?

The average exchange rate during 2013 was §1 = $.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $.90. The exchange rate at December 31, 2013 was §1 = $.84. Assuming that the foreign country had a highly inflationary economy, at what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2013 U.S. dollar income statement?

Definitions:

Repudiates

The action of refusing to accept, acknowledge, or be associated with; in contract law, it refers to the refusal to fulfill contractual obligations.

Sober

A state of being free from the influence of alcohol or drugs, characterized by clear thinking and the absence of intoxication.

Agency Agreement

A contract in which one party (the agent) agrees to act on behalf of another party (the principal) in business transactions.

Commission

A fee or percentage of a transaction paid to an agent or broker for facilitating a sale or service.

Q3: From Missouri to central Ohio to Pennsylvania,many

Q16: Cell products such as undigested residues are

Q16: The statement that the large anatomical differences

Q32: McGuire Company acquired 90 percent of

Q51: A local partnership was considering the

Q61: Pell Company acquires 80% of Demers

Q67: What happens when a U.S. company purchases

Q82: A spot rate may be defined as<br>A)The

Q94: Panton, Inc. acquired 18,000 shares of

Q109: On January 1, 2013, Musial Corp. sold