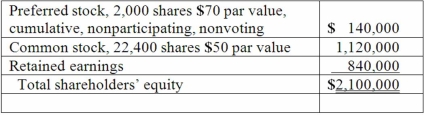

On January 1, 2013, Bast Co. had a net book value of $2,100,000 as follows:

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Definitions:

Early Majority

A segment of consumers adopting new products or innovations just before the average person, following the innovators and early adopters.

Consumer Adoption Process

The stages consumers go through in accepting and becoming loyal users of a new product or service, including awareness, interest, evaluation, trial, and adoption.

Simulated Test Market

A market analysis tool where a new product is introduced to a sample of consumers in a controlled environment to forecast its success.

Product Launch

The introduction of a new product into the market, involving promotional strategies to create awareness and sales.

Q7: Why is push-down accounting a popular internal

Q15: Certain balance sheet accounts of a foreign

Q27: What happens when a U.S. company purchases

Q34: Keenan Company has had bonds payable of

Q45: A partnership began its first year of

Q51: Assume the partnership of Dean, Hardin,

Q73: Bullen Inc. acquired 100% of the

Q77: On January 1, 2013, the Moody

Q90: For business combinations involving less than 100

Q109: Where do dividends paid by a subsidiary