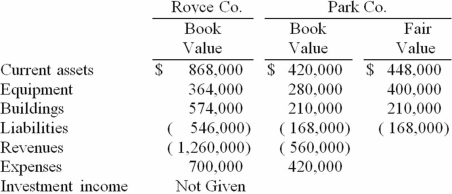

Royce Co. acquired 60% of Park Co. for $420,000 on December 31, 2014 when Park's book value was $560,000. The Royce stock was not actively traded. On the date of acquisition, Park had equipment (with a ten-year life) that was undervalued in the financial records by $140,000. One year later, the following selected figures were reported by the two companies. Additionally, no dividends have been paid.  What is consolidated net income for 2015 attributable to Royce's controlling interest?

What is consolidated net income for 2015 attributable to Royce's controlling interest?

Definitions:

Finely Crystalline

Describes a rock texture that consists of small, closely-packed crystals not easily visible to the naked eye.

Calcite

A common mineral form of calcium carbonate, critical in the formation of limestone and marble, and involved in many geological processes.

Metamorphosed Fossils

Fossils that have undergone metamorphism, altering their original form and composition due to heat and pressure.

Axial Surface

An imaginary surface connecting all the hinge lines of a fold or a series of folds, often perpendicular to the direction of the fold.

Q17: Skipen Corp. had the following stockholders'

Q17: Following are selected accounts for Green

Q22: An acquisition transaction results in $90,000 of

Q23: Following are selected accounts for Green

Q23: On January 1, 2012, Smeder Company, an

Q35: Parker Corp., a U.S. company, had the

Q47: Sinkal Co. was formed on January 1,

Q60: Cayman Inc. bought 30% of Maya

Q90: A foreign subsidiary of a U.S. corporation

Q114: On January 1, 2013, Jackie Corp.