On January 1, 2013, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.

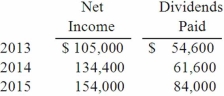

Carper earned income and paid cash dividends as follows:  On December 31, 2015, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

On December 31, 2015, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

Required:

If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2015?

From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.

Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest.

Definitions:

Encrypted Servicing

The process of providing services through secure, encrypted communications to protect sensitive information.

Faulty Design

Describes a product, structure, or system that has inherent flaws or errors in its design, leading to inefficiency, malfunction, or potential hazards.

Service Technicians

Professionals who specialize in the maintenance, repair, or installation of technical equipment, often requiring specific skills and certifications.

Downstream Firms

Companies that operate closer to the end-user or consumer in the supply chain, typically involved in the distribution, retail, or post-production stages.

Q12: On January 1, 2013, the Moody

Q13: On January 1, 2015, John Doe Enterprises

Q30: Several years ago Polar Inc. acquired

Q35: On January 1, 2012, Smeder Company, an

Q64: On January 1, 2012, Jumper Co. acquired

Q71: Which of the following statements is false

Q94: On 4/1/11, Sey Mold Corporation acquired 100%

Q100: Reasons for global standardization of manufacturing systems

Q103: Panton, Inc. acquired 18,000 shares of

Q109: On January 1, 2013, Musial Corp. sold