On January 1, 2015, John Doe Enterprises (JDE) acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.

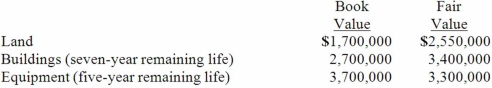

On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2015.

For internal reporting purposes, JDE employed the equity method to account for this investment.

For internal reporting purposes, JDE employed the equity method to account for this investment.

Prepare a schedule to determine goodwill, and the amortization and allocation amounts.

Definitions:

Authoritarian Societies

Societies characterized by strict obedience to authority at the expense of personal freedom.

Gender Roles

Social and behavioral norms that are considered appropriate for individuals of a specific gender within a certain culture.

Innate Biological Differences

Natural variations in physiological or genetic characteristics that exist among individuals from birth.

Genes

Units of heredity made up of DNA that are responsible for the genetic traits passed from parents to offspring.

Q22: An acquisition transaction results in $90,000 of

Q26: Cashen Co. paid $2,400,000 to acquire all

Q26: Cayman Inc. bought 30% of Maya

Q45: Peterman Co. owns 55% of Samson Co.

Q49: Acker Inc. bought 40% of Howell

Q54: Parent Corporation acquired some of its subsidiary's

Q58: Pell Company acquires 80% of Demers

Q85: When consolidating a subsidiary under the equity

Q87: Carnes has the following account balances

Q97: Which of the following statements is false