On January 1, 2011, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

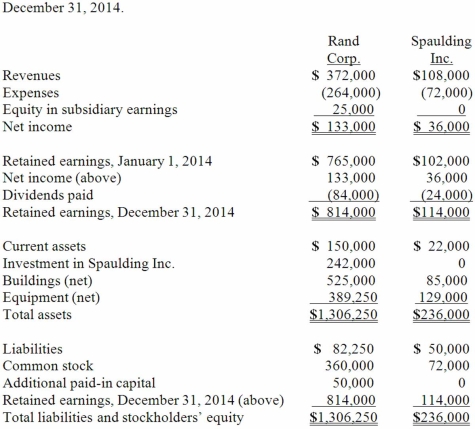

Following are the individual financial records for these two companies for the year ended December 31, 2014.

Required:

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Intellectual Disability

A condition characterized by significant limitations in intellectual functioning and adaptive behavior, appearing before the age of 18.

DSM-5

The Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition, a comprehensive classification of mental disorders by the American Psychiatric Association.

Ethnic Differences

Ethnic differences refer to the variations in customs, values, behaviors, and attitudes among groups of people identified by their shared culture, heritage, language, or national origin.

IQ Scores

A measurement indicating a person's cognitive abilities in comparison to the general population, typically standardized to a scale where 100 is average.

Q1: The financial statements for Goodwin, Inc.

Q22: Pell Company acquires 80% of Demers

Q28: Utah Inc. acquired all of the

Q32: Watkins, Inc. acquires all of the

Q33: The financial statements for Goodwin, Inc.

Q36: On January 1, 2014, Palk Corp.

Q63: Export marketing plans should be specific about

Q69: On January 1, 2013, Nichols Company

Q82: When comparing the difference between an upstream

Q119: Kaye Company acquired 100% of Fiore Company