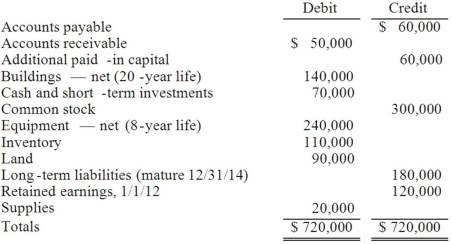

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2012. As of that date, Jackson had the following trial balance:  During 2012, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2013, Jackson reported net income of $132,000 while paying dividends of $36,000.

During 2012, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2013, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2012, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2012.

(B.) Prepare consolidation worksheet entries for December 31, 2013.

Definitions:

"QNS"

Stands for "Quantity Not Sufficient", indicating that a sample size is inadequate for testing or analysis.

"CMA"

Can refer to a Certified Management Accountant, a professional certification for accountants and financial professionals in business.

Certificate Of Waiver

A document that exempts the holder from having to comply with certain regulations or requirements, often in a healthcare or regulatory context.

Quality Assurance

The systematic process of verifying whether a product or service meets specified requirements.

Q26: Pell Company acquires 80% of Demers

Q29: How would consolidated earnings per share be

Q42: A parent company owns a controlling interest

Q63: On November 8, 2013, Power Corp. sold

Q64: On January 1, 2014, Jannison Inc. acquired

Q90: Hiring others to perform some of the

Q93: On a consignment sale,the payment risk is<br>A)

Q95: Factors that should be considered in determining

Q109: Discuss the problems associated with global sourcing.

Q147: What is an export license?<br>A) Permission from