On January 1, 2011, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

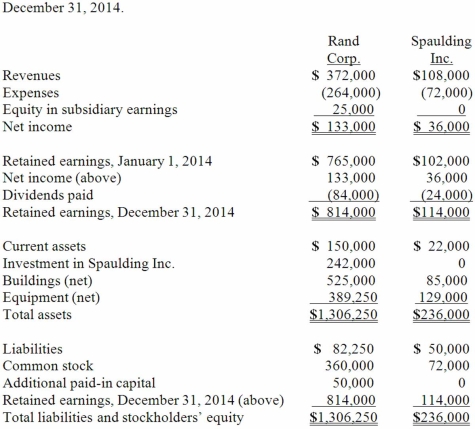

Following are the individual financial records for these two companies for the year ended December 31, 2014.

Required:

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Initial Encounter

The first visit or consultation for a new condition in the medical setting.

Nonessential Modifiers

Descriptors that are not absolutely necessary to have been included in the physician’s notes and are provided simply to further clarify a code description; optional terms.

Brackets

Used in writing and mathematics to enclose words or numbers for clarity.

Parentheses

Punctuation marks used in writing to enclose additional information or clarify something without interrupting the main text.

Q23: Perch Co. acquired 80% of the common

Q29: How would consolidated earnings per share be

Q32: Generally,it is easier for international firms to

Q33: On January 3, 2013, Roberts Company purchased

Q39: The following information has been taken from

Q53: According to the FASB ASC regarding the

Q96: Steven Company owns 40% of the outstanding

Q99: Acker Inc. bought 40% of Howell

Q116: Measurement of supply chain performance varies by

Q145: _ is a companywide management approach in