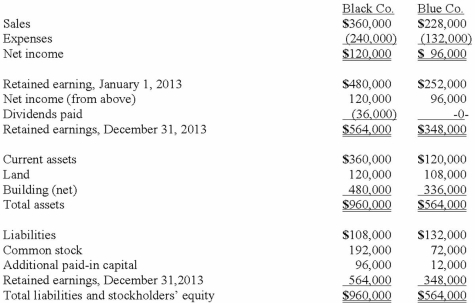

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 2013.  On December 31, 2013 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

On December 31, 2013 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2013.

Definitions:

Adaptive

Describes the ability of an organism or system to adjust to changes in its environment or to cope with disturbances.

Humor

A quality of being amusing or entertaining, often expressed through jokes, comedy, or playful behavior.

Catastrophic Thinking

An irrational thought pattern where one assumes the worst possible outcome will occur, often seen in anxiety and depression.

Rational Analysis

The process of evaluating problems and making decisions based on logical reasoning and factual evidence.

Q2: Parsons Company acquired 90% of Roxy Company

Q4: Prior to being united in a

Q17: During January 2012, Wells, Inc. acquired 30%

Q39: Companies engage in outsourcing when they make

Q43: Gargiulo Company, a 90% owned subsidiary

Q45: Fraker, Inc. owns 90 percent of Richards,

Q66: Incoterms describe the three issues that arise

Q69: How does the partial equity method differ

Q97: Which of the following is not typically

Q106: An unconditional order drawn by the seller