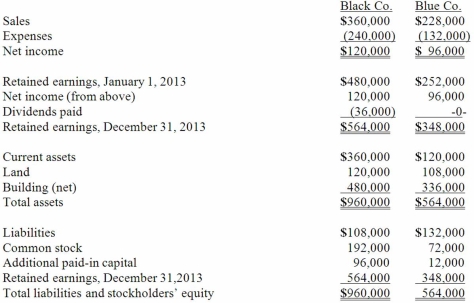

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 2013 prior to Black's acquisition of Blue.  On December 31, 2013 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $60 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

On December 31, 2013 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $60 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2013 after the acquisition transaction is completed.

Definitions:

Corporate Strategy

Involves the overarching plans and objectives a company adopts to achieve competitive advantage, growth, and sustainability.

Tactical Plan

A short-term strategy designed to address specific goals, often as part of a broader strategic plan.

Tactical Plans

Short-term actions designed to achieve specific objectives, often as part of a larger strategic plan.

Strategic Plans

Long-term, comprehensive blueprints for how an organization will achieve its goals and meet the expectations of its stakeholders.

Q24: Perch Co. acquired 80% of the common

Q29: Following are selected accounts for Green

Q51: Stark Company, a 90% owned subsidiary of

Q63: When consolidating a subsidiary that was acquired

Q68: How would you account for in-process research

Q68: Acker Inc. bought 40% of Howell

Q92: Exporting using ocean freight rather than air

Q95: _ are universal trade terminology developed by

Q132: In U.S.industry,the proportion of purchased materials in

Q133: The EU is a supranational body that